What Is Open Banking and How Does It Impact Banking Software Development?

Open banking market revenue reached $10.39 billion in 2021 and it is very likely to grow in the coming years. The number of users of open banking services is expected to grow rapidly by up to almost 67% (from 28.4 million in 2022 to 42.6 million in 2023) according to the specialists of the Statista portal. Thus, implementing services based on open banking enhances the competitiveness of the bank and can help retain customers.

PSD2 - open banking

Open banking is defined in the European PSD2 directive. It applies to payment services. The directive requires all EU-based banks to grant access to customer transaction accounts to both retail and corporate users. The sharing of this data is to be done through open APIs and applies to all Payment Service Providers (PSP), such as banks, payment institutions, and Third Party Providers (TPP). PSD2 applies directly to all types of electronic payments and has led to many innovative services and revolutionary developments not only in banking but also in the financial industry in general.

What is open banking? Definition, benefits and risks

Open banking describes the process of banks and other traditional financial institutions providing users and third parties with easy digital access to customers' financial data. The term also refers to allowing a third party to initiate transactions from a customer's account, such as sending payments or withdrawing money.

For consumers, sharing banking data with financial solution providers can mean the possibility of getting better and cheaper offers for the services they currently use. According to a report created by PwC, 39% of bank customers want to share their financial data if it is to benefit them with better-tailored offers. The possibility of efficiently transferring private customer data between different systems can make it easier to manage financial products from different entities by combining them within a single user panel.

Open banking increases competitiveness in the financial sector. New banking standards open up a number of benefits for small businesses and improve the efficiency of possible cooperation between financial institutions. However, there are many challenges for the financial services industry — including some risks related to customer data privacy and cyber security. The primary risks include data leaks and the potential vulnerability of APIs to attacks. However, it’s worth remembering that banks are doing their best to secure well the data they share. Transmitted information must be encrypted, and entities using open banking must follow the rules set forth in the GDPR (General Data Protection Regulation).

What information is shared with open banking?

The concept of open banking includes the ability to download and share information about account balances, payments, transactions, and investments. The list of data that can be uploaded may vary depending on the region in which a particular bank operates. Examples of information include personal information of the account owner (first name, last name, etc.), identification number (e.g., company Tax ID), address, categories of conducted business, account information regarding deposits or securities, and transaction numbers.

It should be noted that a lot of innovative financial services wouldn’t have been created if it weren’t for the development of the latest trends in the banking industry. The opportunities introduced by open banking couldn’t exist if customers didn’t allow third-party providers (TPP) to access their financial data.

To initiate and deliver quality products and services, third-party service providers must obtain customers' consent to secure, filter, and process certain information. Such consent for processing usually follows several steps:

- The service provider asks for consent to use information.

- Customer authenticates themselves and gives consent.

- Consent becomes visible to both the bank and the service provider.

Once consent is granted, the bank can start sharing customer data.

How does data sharing work? APIs in open banking

An application programming interface (API) can be understood as a set of functions that allows applications to communicate and exchange information with each other. There are many types of APIs in the financial market. An interface for open banking allows rapid transfer of customer data between banks and providers of other financial services.

The biggest problem in developing and using the open banking API is the complexity of the API integration process, due in part to a lack of standardization. Fortunately, financial companies, operating in specific markets, are trying to define these standards to increase the security and efficiency of the shared information.

What is open banking? Examples

Open banking and efficient data exchange have allowed the creation of a range of new financial services and tools.

Payment Subscriptions Management

Subscriptions are a relatively new service on the financial market, very similar to recurring transfers that can be requested through banks. Unlike them, however, subscriptions don’t use funds from the customer's main account, but recurring and continuous transactions using payment cards are enabled.

Linking a card as a payment source to a subscription service is convenient and one-time only. All you need to do is enter your card details. Unlike recurring transfers, it allows for chargeback, that is, the ability to get money back when a subscription doesn’t work properly. Such automated payments don’t involve any commissions, and the cardholder doesn’t have to perform any additional actions (initiate further transactions, pay commissions to payment intermediaries, etc.).

Subscription management detects all of a user's recurring payments (e.g., bills, fitness club membership transfer, loan installment), shows them in a single interface, and suggests automating them. From the relevant application, the customer can manage recurring payments - cancel unwanted subscriptions, create new ones and receive notifications of upcoming payments.

In Poland, subscription payments are made possible, among others, by Blue Media. Payment is charged to the card added to the system by the customer. The customer is only required to authorize the card once. Any subsequent transaction takes place without their involvement - automatically. The customer can change the card to another one at any time.

Deferred payments

Buy now, pay later, i.e. deferred payments, is one of the latest trends that has gained popularity in times of a pandemic. The main objective of introducing this payment method is to ensure the highest possible purchase conversion rates by providing customers with additional short-term and interest-free purchasing options. Open banking has enabled the creation of a financing mechanism that allows customers to make purchases without having to pay the full price of the product right away. Customers have the option of spreading the price over several installments, often interest-free. By integrating open banking into this service, suppliers processing this payment method can improve their acceptance rates and issue more positive decisions to potential customers.

In Poland, deferred PayPo payments can help a company improve its conversion rate and even increase the value of the basket (by up to 60%, according to PayU which participates in this process). According to the company, it’s a suitable form of payment for customers of brands selling luxury and expensive products, as it enables them to make purchases at a convenient time. In addition, the availability of this payment method increases the value of the basket during seasonal sales, as customers are more likely to opt for larger purchases. If the customer has already used PayPo before, all he or she has to do to make a purchase is confirm the transaction with an SMS code (for first-time purchases, they have to enter their details). PayU transfers the funds to the shop and then recovers the amount from the customer. They have as many as 30 days to pay the debt, after which the amount due is divided into four installments.

Aggregation of accounts and information about customer services

Open banking involves sharing customer information with different service providers. This allows consumers to integrate their accounts and view their data (including those for ongoing transactions) in one place, and even perform different types of transactions from them. The tools for managing the customer's financial products are likely to develop with new services in the near future.

In Poland, viewing data from other banks is made possible by Millennium, among others. Thanks to open banking, in Millennium bank's mobile application, customers can see their account balance from another bank. Not only can they check the number of funds held with another entity, but they can also check their spending history.

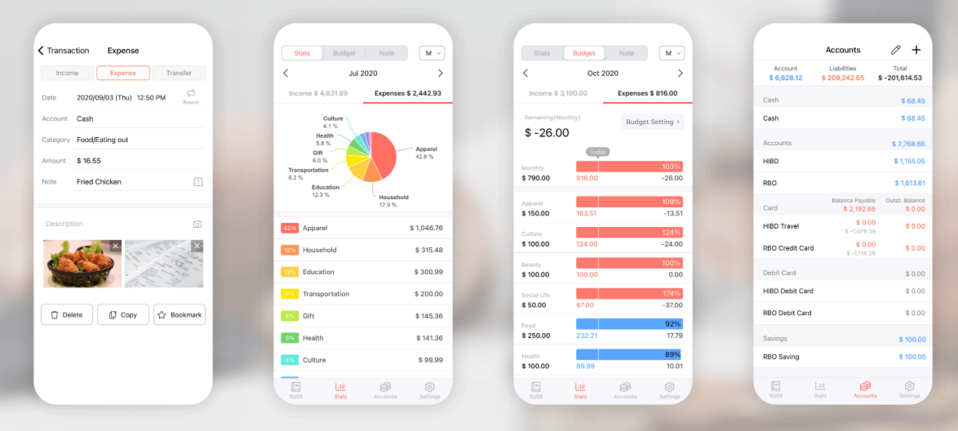

Meanwhile, the fintech application Money Manager makes it easier to manage your budget. It allows you to view your expenses and account balance. All information is presented by means of a chart, among other things. A bank account and a debit card can be linked to the application so that all transactions are recorded in the application. The developers of the application have also enabled users to make payments (ordering transfers, direct debits, etc.).

Source: RealByte

Integration of IoT devices and open banking

Open banking and the integration of banking applications with voice assistants such as Siri or Alexa could enable very fast payments (e.g. paying bills). Currently, companies are just working on such solutions, but in the future, an open banking API could allow different systems to communicate with each other, thus offering the consumer better communication and choice of services.

Benefits of using open banking

Technology development has led to the identification of new potential uses for open banking and today it’s possible to take advantage of many services that wouldn’t have occurred to anyone at the initial stages of open banking.

Better personalisation of financial offers

Companies offering financial services and products, using the potential of open banking, are able to offer better advice and better packages. This is because they have full insight into the assets and liabilities and other relevant information about the consumer. They can therefore carry out complex analyses and create a more tailored offer. Effective personalization is made possible by having access to all key information digitally and in real-time.

Faster processing of customer applications

When applying for a loan, customers have to send a lot of information so that the lender can assess their creditworthiness. This makes the process cumbersome and lengthy, both for the service provider and for the customer, who waits a long time for their application to be processed. Open banking streamlines this process by allowing real-time access to information without the consumer having to complete the documentation themselves.

Easier management of financial products and services

Gathering data from multiple accounts in one place is already offered by many banks and financial services companies. This involves the use of the aforementioned API. After the user has given their consent, data from different systems become visible in one application. This makes it easier to analyze expenses and receipts on an ongoing basis, as well as make financial decisions.

What is open banking? Summary

The implementation of services based on open banking will have a positive impact on the customer experience, cooperation with external entities, and the efficiency of the bank. However, such implementation should be preceded by adequate preparation. Upgrade your systems and make sure you are up-to-date on the latest banking trends to enable faster and more efficient development of financial services. Explore partnerships with external companies and use consumer data analytics to create or co-create new solutions to problems related to financial services. We can help you implement state-of-the-art solutions for the financial industry on your website in line with current open banking standards.