What are the Most Popular Ecommerce Payment Methods You Can Use in Your Store?

Nowadays, customers expect more and more freedom in choosing the payment option and they may resign from making a purchase on your platform if they don’t find the payment method that suits their preferences. Unfortunately, not every business can afford to implement an infinite number of payment methods. That’s why it's worth analyzing the possibilities available on the ecommerce market and selecting a few of them.

Why is it worth offering various electronic payment methods?

While the process of browsing and selecting products is entertaining for many users, finalising an order is a necessary evil, so it should be simple and time-efficient. It may seem that until recently, the only payment options for products ordered online were cash on delivery from the mail carrier or courier or payment by traditional bank transfer. In the case of cash on delivery, the seller had to wait a long time for the money earned from the sale. If a customer decided to pay for an order by traditional bank transfer, they sometimes had to wait several days for the payment to be posted and for the product to be dispatched. Today, companies aim to guarantee users maximum comfort and freedom during the shopping experience by simplifying transactions. The market is more flexible and geared towards meeting customer needs. Various companies offer consumers and vendors many convenient solutions for paying for products and services. Nevertheless, not all ecommerce businesses give their customers enough choice.

The consequence of making few payment options available is often the abandonment of the shopping basket at the final stage of purchase, when the customer realizes that they can’t use their favourite online payment method. There is a trend towards adding as many electronic payment options as possible among ecommerce giants. Surely, you know from your own experience that the largest marketplaces allow customers to pay not only by regular bank transfer but also by BLIK, through intermediaries such as PayU, by card and even with cryptocurrencies. The implementation of multiple ecommerce payment methods on a sales platform usually brings about:

- a significant reduction in basket abandonment at the payment stage,

- improvement of the ecommerce experience of the customer,

- increase of the credibility of the sales platform.

Trends in implementing new payment methods in online stores are unambiguous - offering multiple, different ways to pay to customers increases the attractiveness of your ecommerce website and has a positive impact on the satisfaction of users shopping on it.

How to choose the right ecommerce payment systems for your online store?

A good payment system is a convenience for both the business and the customer. With almost instant confirmation of payment, neither party has to wait for the payment confirmation to be sent or for the bank to process the transfer. This significantly speeds up the exchange between the vendor and the customer.

When choosing a solution and an electronic payment operator, it’s worth analyzing the available options carefully in terms of:

- security of the transaction — before making your final choice, check whether the given company has the relevant certificates and partnership agreements with VISA or MasterCard,

- payment automation — make sure that the operator allows for the return of funds via API, so that the return process doesn’t require any action from your employees,

- number of available payment methods — the more payment options you can provide to your customers, the more likely they are to complete the transaction,

- costs and commissions — each payment system provider determines the method of settlement for using its services (a fixed fee for each transaction, a percentage of the amount, a subscription),

- freedom to withdraw funds — it’s obvious that you want to have access to the money you have earned at all times, so choose an online payment service provider that doesn’t restrict withdrawals from your account (unfortunately, some intermediaries impose restrictions on corporate customers),

- access to transaction history — constant insight into what is happening on your account is very important as it allows you to monitor your revenues and withdrawals.

When preparing to decide on a working with an online payment provider, you need to consider not only what is good for you, but also most importantly what is good for your customers. Read the latest surveys and reports to find out which payment options are most popular among your target groups.

Popular ecommerce payment methods

You can implement multiple payment methods in your online store. How do you decide which of them should be made available to your customers and which are unnecessary? Analyze the possible solutions to find the right one for your target group.

1. Quick transfers

Making a payment using a quick transfer is extremely easy and fast, unlike traditional transfers where you have to manually enter the recipient's details and wait for the payment to be processed by the banks of both the client and the vendor. After clicking on the button Order and pay, the customer is redirected to the website of the payment operator and selects the bank in which they have an account from which they want to pay for the order. There is no need to fill in any online banking form or enter an account number, as all recipient and order data is automatically retrieved by the system. This not only speeds up the payment but also eliminates the risk of an incorrectly entered account number. Simply confirm the payment according to the method selected in your own electronic banking (usually by entering on the bank's website a code received in a text message or by accepting the transaction in the mobile application).

Money sent using quick transfers is credited to the vendor's account instantly, thanks to which they can process the order quickly, without having to exchange any further information with the customer (like sending confirmation of the transfer). The fee for this payment method is usually a percentage of the transaction amount. The commission is collected by the company processing the payment, like PayU. The vendor has to pay for each sale. What is more, the fee is non-refundable. If the customer resigns from the purchase after the payment has been processed, the commission is retained by the intermediary.

2. BLIK

BLIK is a payment method whose application is limited to the Polish market, but this may soon change. Given the popularity of this payment method in Poland, it is quite likely that the use of BLIK will also spread abroad. This electronic payment option makes it even more efficient than quick transfers do because it doesn’t require logging on to the bank's website at all. Instead, the customer has to log in to the bank's mobile application. However, today this can be done expressly by entering a special PIN or putting a finger on the fingerprint reader. Then, with a single click, you generate a six-digit code, valid for two minutes only, and enter it in the appropriate field on the website or using the terminal and confirm the operation in mobile banking. As in the case of quick transfers, the money is immediately credited to the vendor's account, so they can immediately start processing the order.

3. Traditional transfers

Although the abovementioned traditional bank transfers are becoming less and less common (we mainly use them to pay our regular bills), you shouldn’t abandon offering this payment method on the website of your online store. This payment doesn’t require any additional systems to be integrated into your website, nor any additional commissions to be paid. This means that 100% of the money the customer transfers goes to the vendor. After placing an order in your online store, the client should receive an automatic email with the transfer details: suggested title, account number and the name and address of the recipient. You can then also ask for a transfer confirmation to be sent (this is optional as both you and the customer can wait for the payment to be posted by the bank). It’s worth offering customers this option of payment as not everyone uses other electronic payment methods, and you don’t want to narrow down the group of people who can buy from your store, right?

It’s true that if a customer chooses a traditional bank transfer as a suitable payment method, the vendor doesn’t pay a commission. However, this method of settlement costs the vendor time, because their company needs the services of someone who will check the transfers.

4. Payment card

Making an online payment by card requires filling out a secure form on the website of the payment gateway provider. The customer enters the card number, expiry date, and CVV or CVC code. As in the case of quick transfers and BLIK, the funds are credited to the vendor's account instantly, so the whole order can be quickly processed and completed. The payment process is very simple and always the same, regardless of the type of payment card. Payment with a card is usually secured in a similar way as transfers, so it is necessary to confirm the transaction in the mobile application or by entering a code, received by a text message, in the appropriate field on the website of the intermediary. However, allowing customers to pay by credit card involves the highest fees.

5. E-wallets

This electronic payment option is slowly gaining popularity worldwide and it’s worth considering implementing it as more and more people are using digital wallets. They function similarly to prepaid cards. The customer tops up their account on the portal, using the associated payment card or bank account. Once the payment method has been selected, the consumer needs only to log into their account using their own email address and password, and then confirm their willingness to make the payment. It will be processed if the person has sufficient funds in their account. The money will immediately appear in the vendor's account, allowing the transaction to be completed quickly.

This payment method has several important advantages. Some e-wallets (e.g. Venmo, Coinbase, eToro) allow customers to trade popular cryptocurrencies. Such payment using an e-wallet guarantees greater anonymity of the transaction as the payer's identifier is only the email address or the individual customer number (if the vendor doesn’t require other information such as the name and surname, card number or bank account number).

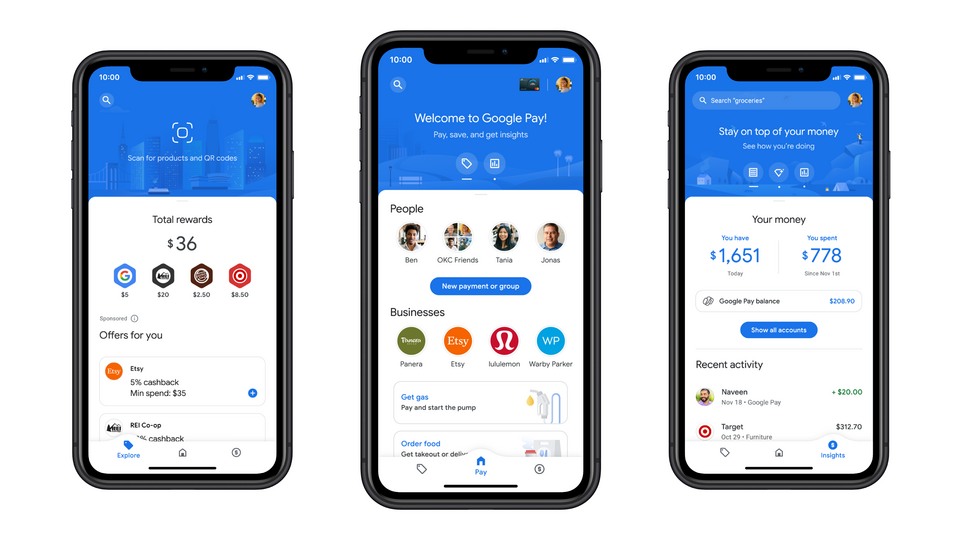

6. Mobile payment applications

Similarly to e-wallets, mobile payment apps are not yet as widespread among consumers as other electronic payment methods. However, the reality is that more and more customers are shopping via smartphone and testing the latest online buying trends, so their popularity is slowly increasing. The best known are Google Pay and Apple Pay. They operate in a similar way to e-wallets. However, the customer doesn’t have to top up a new account, but only add the payment card in the selected application. The mechanism of their operation is very simple - the customer has to add the data of a payment card of their choice in the application and then they can pay both in online stores and by contactless method in physical shops and other premises without having a card with them.

Source: TechCrunch

Some applications, such as Apple Pay, require you to confirm the transaction with your fingerprint each time, which prevents unauthorized payment by someone who may gain possession of your mobile device through theft. Funds appear in the recipient's account just moments after payment confirmation.

Drupal Commerce payment modules

When deciding to create their own online stores, many companies consider using open source solutions. There are many reasons to choose Drupal for building an ecommerce website. It’s flexible and allows using advanced functionalities for online stores. One of the advantages of this platform is the availability of numerous interesting payment modules. The multitude of modules available to enable payments in your online store make Drupal the right technology to build a personalized ecommerce website.

When paying online, the most important aspect is to ensure that the customer feels secure. Integrating the Commerce Stripe module allows you to create a tokenized payment gateway on your website. This means that purchasers will be able to make payments in the Drupal-based store without leaving the website.

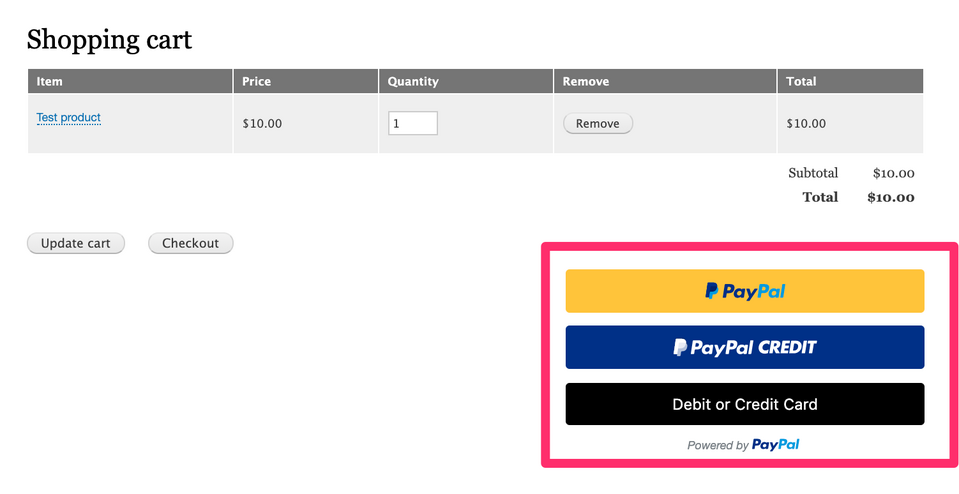

Among the most popular payment solutions is Commerce PayPal. PayPal services are known and used by many customers. While the Commerce Authoize.Net module allows you to provide customers with the ability to pay with Visa, MasterCard, American Express cards and use JCB, Discover, PayPal, Visa SRC, Apple Pay, Chase Pay and E-check. If, on the other hand, you sell only on your home market, it’s worth considering implementing payment methods appropriate for that country.

Source: Drupal.org

Payment options in Sylius

Sylius is another open source solution worth considering when thinking about which technology to use to create your online store. Ecommerce websites built with this platform are scalable and functional.

Sylius allows implementing payment methods supported by various suppliers. The Payum library contains solutions for implementing efficient payment options in your online store.

The shops built with this framework can support quick transfers, payments with cards or e-wallets, etc. New payment methods can be freely added by developers using appropriate plugins, e.g. BitBag, thanks to which your customers will be able to use the possibilities offered by providers of electronic payment services, like PayU.

Ecommerce payment methods - summary

There are a number of electronic payment methods that you should consider implementing when building an ecommerce platform. The more of these you offer to a customer, the more likely they are to make a purchase. Moreover, offering few payment methods may discourage some customers from making purchases in your online store. It’s also worth choosing the online payment provider carefully - each of them offers different conditions of collaboration. We can help you choose and implement the most cost-effective options for your business with our ecommerce services and advise you on the best solutions for your online store.