What Possibilities Does Using a Financial API in Business Bring?

The constant development of new digital channels and applications has changed the way clients use financial services and products. Fewer and fewer people visit bank branches and more and more want to access their services on a smartphone or other device. Banks and other financial institutions must, therefore, adapt to clients' expectations, offering their services through multiple communication channels and using application programming interfaces (APIs).

What is a financial API?

An application programming interface (API) is a set of functions and procedures that allow certain systems or applications to access data, thus increasing the functionality for the user of a bank website or application. APIs connect and allow information to be exchanged between various unrelated systems.

In the world of finance, various APIs are used, for example, API in the stock market is used to collect in a single place the data helping users make investment decisions (the information related to shares and cryptocurrency markets). A financial news API is a tool that allows you to easily access the latest news from the financial industry, and an open banking API allows exchanging information about clients between banks and other external systems.

There are many advantages to using various APIs. Thanks to better communication, brands have access to detailed information about clients. Companies are able to increase the revenue from the implemented APIs by analyzing a larger amount of various data. Experts around the world forecast that APIs and client information will become important resources, as financial institutions work on preparing new ways of generating revenue. Monitoring the performance and using an API will help determine which areas of the interface are highly effective (what generates the most traffic and what causes problems).

The development of open banking systems will give the banking sector access to incredibly extensive and diverse data sets that companies can use to personalize offers or services. Currently, charging for various API-based services is under consideration. Creating such a business model is obviously a new idea in the banking and financial sector, so it'll probably take some time for banks to develop optimal monetization methods within API.

Types of financial APIs

The basic types of APIs used in the financial industry include:

- Internal APIs – are used within financial organizations in order to improve information exchange to boost the overall performance, develop new products, and manage data in a more secure manner. They allow reducing expenses thanks to automation, and significantly reduce the risk associated with the exchange of information.

- Partner APIs – these APIs connect data between two organizations. This allows two entities to cooperate, by acting as a link between a third-party partner and a bank. Such APIs are usually used when a third-party company helps a bank to create a new product or service.

- Open APIs – They differ from partner APIs in that they share financial data with multiple third-party service providers, not just one. This makes it possible for clients to securely share information such as account and billing numbers, balances, and transaction history. Open APIs allow building useful financial applications and services.

Examples of using a financial API

Implementing a financial API allows introducing a number of solutions popular in the banking sector and beyond. Below you'll find examples of using APIs in the world of finance.

OpenAPI

The introduction of the PSD2 Directive had a significant impact not only on banking but also on the shaping of trends in the FinTech industry. One of these is the widespread implementation of an open API interface that allows access to data on the basis of an open standard (unlike the closed format, such information has an open, publicly available specification and structure that allows anyone to use it). Thanks to a financial API and open banking, consumers are able to monitor their own bank accounts more efficiently (without having to switch between applications) and quickly react to any possible fraud. Integration of accounts allows clients to better and more conveniently manage their finances.

Companies are implementing open banking APIs to create new services and make it easier for their clients to manage their finances. More and more banks are doing this. ING talks about the advantages of using APIs in their solutions for businesses. The ING Accounting OpenAPI allows clients to automatically issue invoices based on data from another system (e.g. an e-shop) and download it in .pdf format. Users can also view the status of the accounts opened in the ING bank and the transaction history in mobile applications or after logging in to other banks' websites. A unique API key made available to the client allows integration with other business applications. The OpenAPIs used by many banks on the European financial market operate in a similar way.

Aggregation financial API

Financial APIs provide a secure way to build and share financial applications and services that use a wide variety of account data, such as account and billing numbers, account balances, transaction data, investments, and more. The integration of the appropriate API allows a fintech application or service to obtain data from other tools (including access to the transaction history approved by the consumer months or years back). This, in turn, allows the user to use many types of financial services and tools (e.g. automated saving, investing, loyalty programs), as well as collect their data in a single application. Thanks to efficient communication between the systems, users can quickly find important information about their finances and are able to conveniently perform operations on their accounts. Clients of banks and fintech companies can use this API to increase their product management efficiency through account consolidation, better spending analysis, and proactive financial management recommendations.

An example of using such an API is Practifi, which is a provider of business financial management solutions for companies. Practifi integrates with the Zapier API to connect and manage various data and applications from a single place.

Financial news APIs

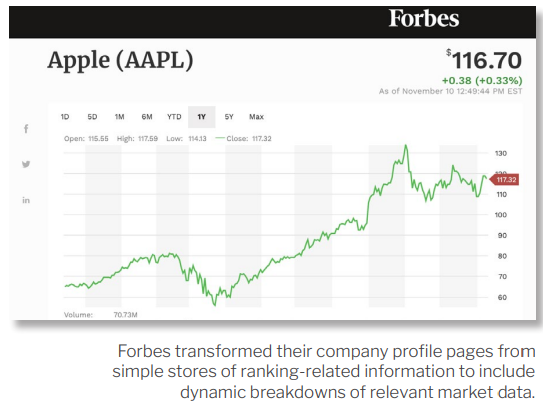

Banks' websites (especially investment and e-banking websites) can display additional information about changes in the stock market, and the increase or decrease in the value of cryptocurrencies. Access to up-to-date data is extremely important for the people interested in investing and running various types of enterprises because it allows them to make the right business decisions faster. Integrating various sources of data and news from the financial industry with a mobile application or website and presenting end users with up-to-date information is possible thanks to efficient news APIs. By having access to important financial information on an investment management website, the user can better control the investment risk.

Xignite is a news API used by Forbes. It's one of the solutions allowing the Forbes platform to automatically display and update financial information.

Source: Xignite case study

Payment API

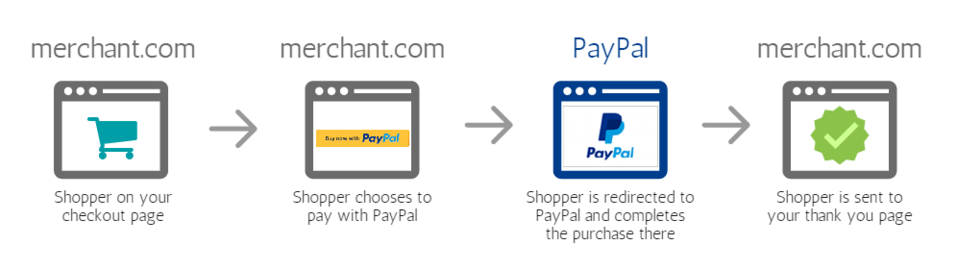

Such an API allows an institution to obtain information necessary to make a payment outside the bank website where the account is established (i.e. on a sales platform) in a way that's safe for the user. Such an API is widely used in the ecommerce industry. In the case of payment API, it isn’t difficult to find examples. Integration with PayPal API allows for accepting payments from the users of PayPal, used by online stores and marketplaces around the world. Thanks to this solution it's possible to increase the security of your clients, as there's no need to store credit card data and bank account numbers on your server. Faster data flow resulting from the use of the potential of a high-quality, financial API allows for much more efficient processing of card transactions, and thus shortens the purchasing process. In this way, brands improve the user experience when using their sales website.

Source: BlueSnap

Another example is BIPS (Bitcoin Internet Payment System). Integration with this API allows for accepting cryptocurrency payments.

Market changes, challenges, and the importance of API in finance

The Mastercard report from the end of 2021 shows that over 80% of US consumers (mostly millennials and Gen Z) link their bank accounts to various financial applications. 9 out of 10 users in the US and Canada use the web and mobile applications for managing money, paying bills, banking, etc. Over 74% of US consumers have expressed a wish to link their bank account to a financial application or service that automates certain financial management tasks (or have already done so). This is possible thanks to using an open API. It's an important trend in the financial services industry, providing both benefits and risks. It allows access to data by providers of various financial services and better personalization of offers, and at the same time makes it necessary to develop more effective methods of protection against cybercrime.

Potential clients may be concerned about the fact that the PSD2 Directive doesn't provide for API standardization. Poorly designed API applications may expose internal systems to cyber-attacks, and the financial sector has always faced the serious challenge of ensuring the privacy and security of user data. It may be reassuring to know that the standards for API, although they weren't imposed in advance, are defined over the course of cooperation by the companies operating in the financial market.

What is a financial API - summary

There are internal, partner, and open APIs. The use of the first two is aimed at increasing the efficiency of a bank or other institution on an ongoing basis, as well as when working on new products. An open API enables end clients to use advanced solutions and allows banks to comply with the provisions of the PSD2 Directive. The implementation of an appropriate financial API allows banks (and other financial institutions) to offer additional functionalities, services, and products to both business and individual clients.

An API complying with the provisions of the PSD2 Directive improves the communication between banks and providers of other services, increasing the comfort of using them. We'll be happy to help you build a financial website using API, which will improve the functioning of your company.